PCI DSS v4.0: What’s Next?

The first version of the Payment Card Industry Data Security Standard (PCI DSS) was introduced by Visa, Mastercard, American Express, Discover and JCB International in December 2004. Please check below points for the complete overview.

1. PCI DSS Background: PCI DSS was introduced in December 2004 by major credit card companies like Visa, Mastercard, American Express, Discover, and JCB International. Its primary goal is to reduce security breaches and fraud related to the exposure and misuse of payment card data (cardholder data or CHD).

2. Formation of PCI SSC: In 2006, the PCI Security Standards Council (PCI SSC) was established to take responsibility for developing, maintaining, and supporting security standards, with PCI DSS being a key component. The PCI SSC works to adapt the standard to address evolving threats and security challenges.

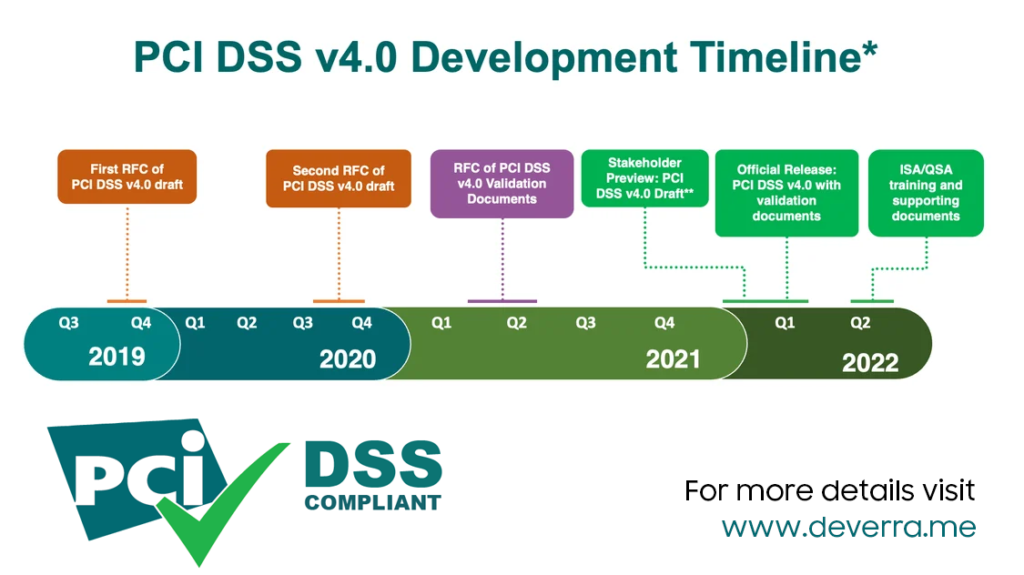

3. PCI DSS Version Updates: To stay effective in the face of an ever-changing threat landscape, the PCI SSC continuously evaluates and updates PCI DSS. These updates can be minor or major, with the most recent release being PCI DSS version 4.0 on March 31, 2022.

4. Challenges and Threats: Common threats such as ransomware, phishing, stolen credentials, and web application attacks remain significant concerns across various industries and organizations, regardless of their size.

5. Transition from v3.2.1 to v4.0: PCI DSS v3.2.1 will be officially retired as of March 31, 2024. After this date, all entities subject to PCI DSS compliance will need to adhere to and be assessed under PCI DSS v4.0.

6. Future-Dated Requirements: PCI DSS v4.0 includes future-dated requirements that are considered security best practices until they must be implemented by March 31, 2025. This recognition of the complexity and cost of some requirements allows organizations time to adapt.

7. Categories of Changes in v4.0: The changes introduced in PCI DSS v4.0 can be categorized into four high-level categories:

· New or updated technical controls reflecting technological advancements.

· Controls related to the direct protection of cardholder data (CHD).

· Improvements in process maturity.

· Enhanced focus on continuous PCI DSS compliance and program management.

8. Seeking Assistance: Organizations looking to assess their readiness for PCI DSS 4.0 or perform gap analysis can reach out for support via the provided contact information.

PCI DSS is crucial for maintaining the security of payment card transactions and preventing data breaches, and staying up to date with the latest version is essential for organizations that handle payment card data.

For more details contact: +973 37290137

Website: www.deverra.me

Email: info@deverra.me

https://deverra.me/pci-dss-compliance-services/

https://deverra.me/pci-3ds-compliance-audits/

Read in LinkedIn: Click Here